Our news

Our latest news

The Énergie Partagée label has just recognized another transformative local project—the Calvisson solar initiative—for its exemplary shared governance and positive regional impact. It now joins the growing family of labeled citizen energy projects [Citizen Energy Map].

Led by the municipality of Calvisson, the ECDC association, and the ACTTE cooperative, the project highlights the value of a local, citizen-driven approach to renewable energy.

Why is this label important?

It certifies that projects meet strict criteria for transparency, environmental benefit, and local economic return. This unique model puts citizens at the heart of the energy transition.

With more than 360 labeled projects across France, the Énergie Partagée label is now a trusted benchmark for impactful, ethical, and sustainable local initiatives.

The citizen movement is growing fast, and this new project proves once again the power of participative energy transition.

🌍 In two months, La Fabrique du Tourisme returns for its 7th edition, this year hosted at EquipHotel! Created in 2020 by EXTENDAM, Bpifrance, and MKG Consulting, the initiative brings together 50+ hospitality leaders to rethink the future together.

💡 At the heart of the discussion: artificial intelligence. How can AI transform natural resource management, waste handling, and satisfaction for guests and staff alike? Expect bold ideas and innovation for the hotel industry.

📅 See you on November 7 at 10:30 a.m. on the EquipHotel Main Stage (Pavilion 7.3) for an exciting lineup of solutions!

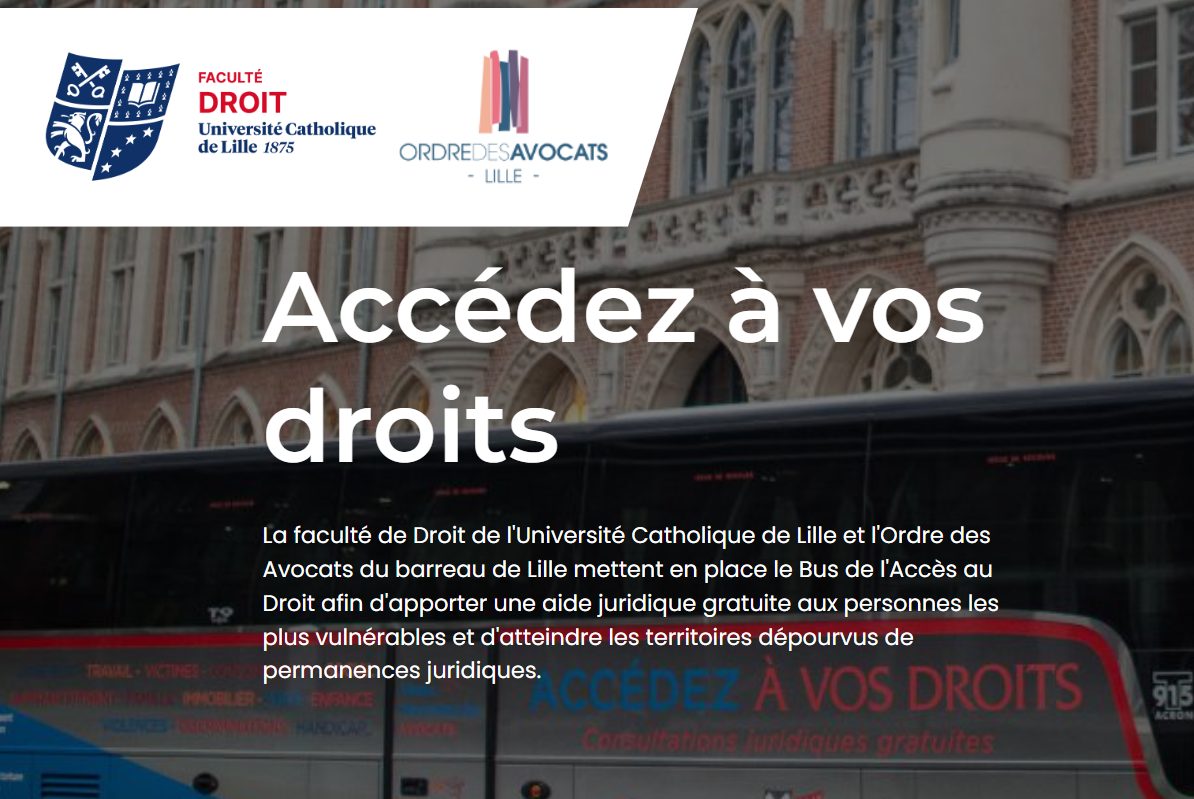

The Faculty of Law at the Catholic University of Lille and the Lille Bar Association have launched an innovative initiative: the Legal Access Bus. This mobile unit offers free legal assistance to vulnerable populations in areas without legal aid offices.

Volunteer lawyers and law students provide consultations covering employment, family, housing, criminal law, debt, and more. The goal? Quality legal support—close to those who need it most.

This initiative fights legal exclusion due to geographic or economic barriers and offers students real-world training under expert supervision.