Our news

Our latest news

Gathered for a keynote session organised by EXTENDAM, Bpifrance and MKG, operators, investors and bankers shared a common assessment: climate issues are profoundly reshaping the financing conditions of the hotel sector.

With rising energy and water costs, increased exposure to physical risks (heatwaves, floods, droughts), and stricter environmental requirements, the ecological transition is becoming a central parameter in business models and investment decisions.

From an investor’s perspective, ESG criteria are now integrated from the very first stage of project analysis. In partnership with Fairmoove Solutions, EXTENDAM has developed an environmental assessment tool for hotels, combined with a plan to constantly improve ESG performances, with incentive or penalty mechanisms depending on achieved targets.

As Maxime Durand, Managing Partner at EXTENDAM, notes:

“It’s not always popular, but it’s effective in driving change in practices.”

➡️ A shift confirming that climate resilience is now a key lever of value and access to financing in the hotel industry.

Every year, millions of clothes are destroyed because they fail to find buyers, while the resources used to produce them are being depleted. Textile waste remains a major challenge.

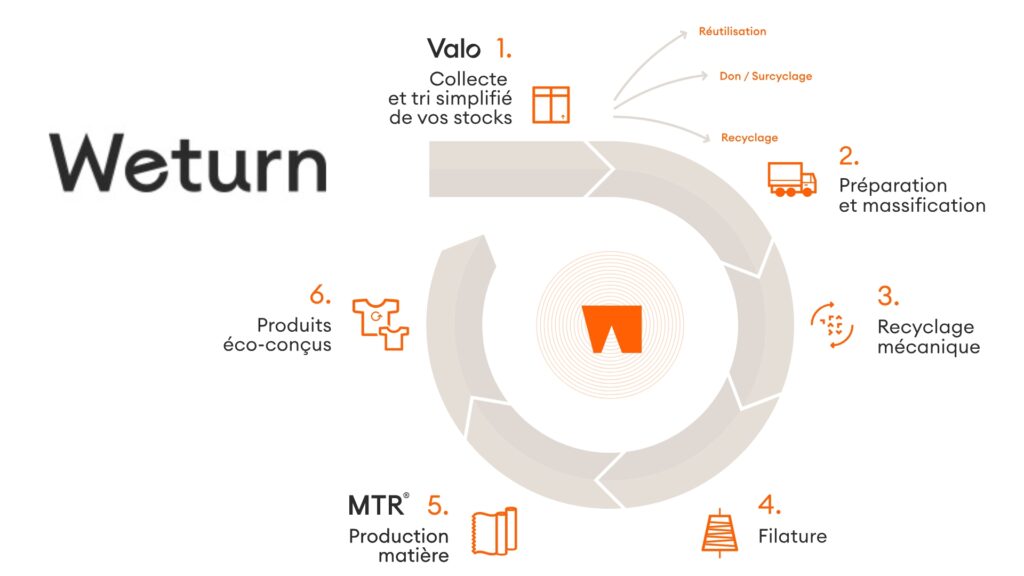

Founded in 2020 by Sophie Pignères, Weturn is transforming the unsold stock management through a complete circular solution: collection, sorting, transformation and upcycling into new raw materials. Its technology gives a second life to dormant inventories and production offcuts, while ensuring traceability and compliance with the French AGEC law.

🎯 Objective: shift fashion from a linear model to a circular economy, reduce waste and limit the tcarbon footprint of textile industry .

🚀 With several hundred tonnes of textiles recycled every year and the support of leading players in responsible fashion, Weturn is asserting itself as a pioneer in the transition toward sustainable and innovative fashion.

In 2025, Énergie Partagée confirms the strength of its citizen investment model once again:

⚡ +2.38% on the share price, now set at €129,

⚡ a gross dividend of €1.20 per share, approved at the General Assembly on 24 November.

Since 2010, more than 190 renewable energy projects have been financed with citizens’ and local authorities’ equity. Once operational, they will cover the electricity consumption of 824,000 people and heat production for 22,500 people.

This performance is driven by the growing maturity of projects selected according to demanding criteria: citizen governance, ecological ambition, territorial roots and technical robustness.

As Erwan Boumard, CEO of Énergie Partagée, states:

“The Énergie Partagée share gains value because the projects we finance are becoming stronger and more profitable. This momentum proves that citizen investment can generate value while strengthening the energy autonomy of territories.”

➡️ An ethical, transparent and accessible investment model for all.